1. INVESTMENT CONSULTING

WHY IS THIS APPROACH MORE EFFECTIVE THAN WHAT PRIVATE BANKS OFFER?

- Because we are on your side and have no conflicts of interest, our ability to produce a consolidated view and subsequent recommendations across all bank portfolios can be of tremendous benefit

- All the banks tend to offer structured products because there are inbuilt commissions. We prefer to explore all potential investment strategies for each goal / asset class. This requires more work, which banks are often reluctant to engage in

- We are a very experienced investment team. Everyone has been in the industry over 20 years and seen multiple boom and bust cycles, and brings that experience to enhance the relationship

ASSETS

- Understanding the clients’ requirements, targets and profiles in order to shape a fit-for-purpose asset portfolio

- Constructing a diversified portfolio of investments spanning multiple geographies, currencies, asset classes, liquidity and risk characteristics

- Periodic reporting across the portfolio

RISK MANAGEMENT

- Financial analysis and cashflow modelling to test the durability of the balance sheet in downside scenarios

ACCOUNT & DATA CONSOLIDATION

Input all holdings held across 4 private banks into our proprietary reporting system – this gave us good insight into single name, industry, geographic and asset exposures

INVESTMENT POLICY & PORTFOLIO CONSTRUCTION

In conjunction with the family, the MFO devised an overall investment policy, portfolio construction and asset allocation

EXECUTION

Implemented the required changes with all 4 banks, encouraging them to engage their research and investment teams to work on ideas, and to be clear about return expectations for each portfolio

PORTFOLIO MONITORING

Ongoing monitoring of the portfolio, with a formal monthly reporting of each bank portfolio and overall status (eliminates ability for banks to hide performance by using different time periods)

DEAL SOURCING & ALTERNATIVE INVESTMENTS

Addition of direct deals that meet family approval and are within the parameters agreed in the investment policy

COST CONTROL

Reduce unnecessary costs and charges being levied by the 4 banks and other providers

The performance has also been much better, on both an absolute and risk adjusted basis, compared to what existed prior to Abbey Road coming onboard

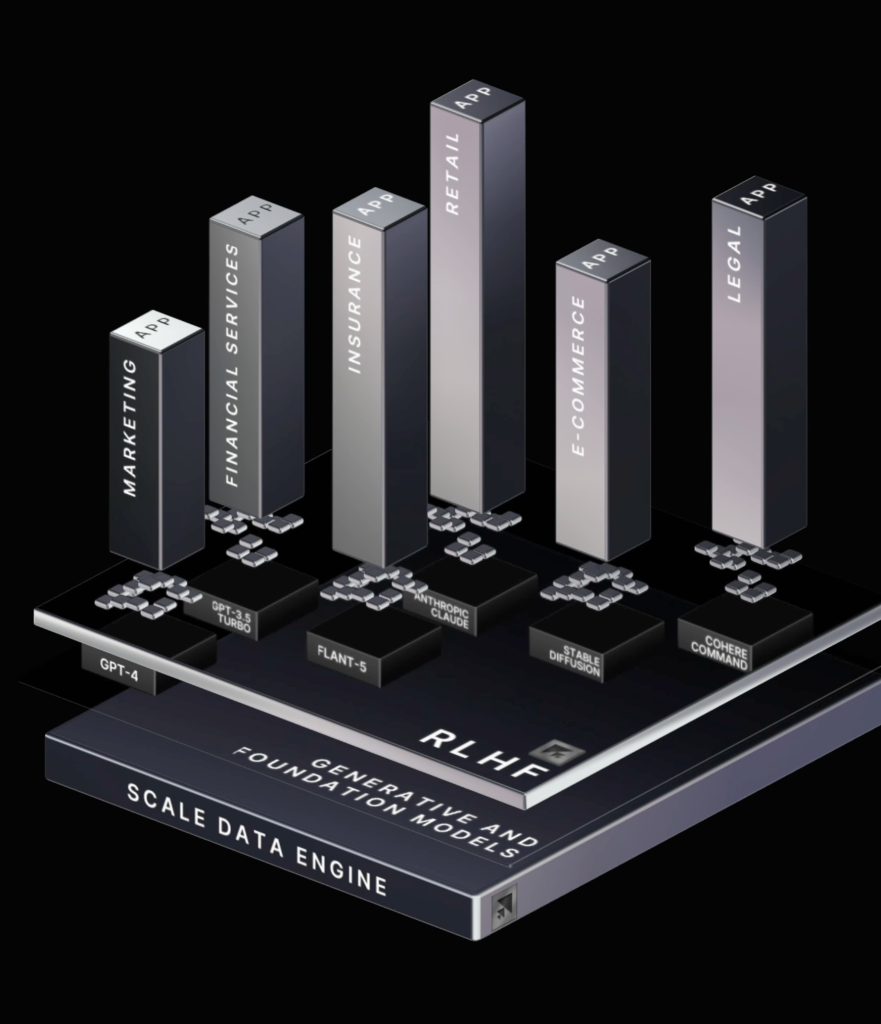

2. ALTERNATIVE INVESTMENTS & DIRECT DEALS

For all Alternative Investments and Direct Deals, Abbey Road performs the entire value chain internally

Sourcing the investment

In depth due diligence on our 3 criteria - People, Product and Potential

Financial model and valuation analysis

SPV and legal documentation

NEWLAB

EAT JUST

PIPE TECHNOLOGIES

FIREFLY

SpaceX

Gecko Robotics

Scale AI

RIGHTFOOT

Everykey

Three Colts

Cart.com

One India Family Mart

FREO

Revfin